www.pdfm.com.gh

ARB Apex Bank Plc, a mini central bank for the Rural and Community banks ( RCBs) in Ghana has on Thursday 13th January, 2022 held stakeholders engagement meeting in the Savannah Regional capital, Damongo towards the revival of defunct Buuwuloso one stop rural bank and how to get community and rural banking to the door steps of the people in the savannah region.

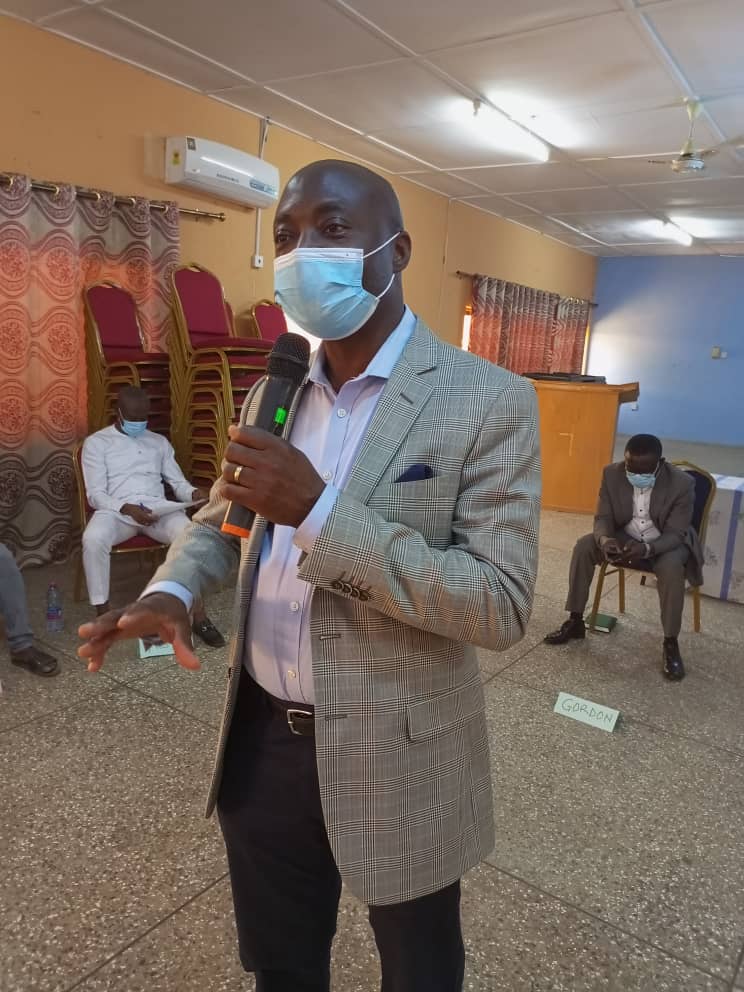

Mr. Jeremiah Seidu, who is the project coordinator for Jaksally Development Organization, an NGO that seeks to empower women, youth and rural communities took time to sensitize the stakeholders present for the engagement session on the importance of Rural and community banking services and the development opportunities it has to offer the people of Damongo and Savannah Region.

Mr. Jeremiah explained that, the engagement with them as people who have interest in the operations of rural banks was to seek ideas from them on the revival of Buuwuloso rural bank and how to get it rebranded to be attractive to the people in the region in other to bring financial opportunities to the people.

The Managing Director of ARB Apex Bank Plc, Mr . Alex Kwesi Awuah explained that, the main concept on which rural and community banks were brought to Ghana was to bring rural banking services to the rural communities and to bring financial intermediation which will enhance the development of the communities and that, our communities can not develop without financial intermediation.

He added that, the establishment of the Buuwuloso one stop rural was with an expectation that within some years, the bank will grow into a significant financial institution to offer the necessary services to the community people but certain things happened and it could not make it.

The Managing Director further explained that, Buuwuloso is not an exceptional as there are so many examples of Rural and Community banks that went into distress some time past and have been revived and are doing significantly well in the country.

He continued that, bigger banks with bigger balance sheets that went into crisis but when the community members showed some interest by mobilizing themselves with some resources, the banks after restructuring never looked back and are doing greatly well and that, they as regulators of rural and community banks thinks that everything begins with the people’s participation and mobilization.

“…. it’s important for us to get the institution back and we can get the community people rallying behind it by supporting it. looking at the history of all rural banks in Ghana, the were institutions that were promoted by the community people and the got setuped and so if we want to revive, we must show interest of getting our bank back once there is an existing license and then sit back as supervisor regulators with the commitment of doing the right things by making sure that, the right people sits at the boards and management position levels of the banks with proper regulations in other not to repeat the governance mistakes that were identified in the previous years ” Mr Alex said.

Mr. Alex Kwesi Awuah further stated that there is the need for the people to understand the relevants of having Rural and Community banks within the savannah region as all rural banks are now networked in their operations and with the help of the government of Ghana and the world bank, the ARB Apex bank Plc has implemented the agency banking platform which goes with mobile banking and internet banking that is make banking services very convenient.

He therefore called for the commitment of the community people and all influencial stakeholders to chat a new path which will be sustainable into the future in other to get Buwulonso one stop bank back in the interest of the people.

The head of Business Development, Marketing and Research at the ARB Apex bank Plc, Mr Gordon P. D. Dery on his side explained that the concept of the rural bank is headquartered at a particular place to serve communities that can access the place and that, there is the need to have community support and ownership in other to have the bank functioning.

Mr Gordon added that, once the community shows ownership and has an interest in the bank, the will ensure that it does not collapse and that, most development partners like to work with community and rural banks because of the community ownership with the view that, when the bring any development agenda or funding, the community will benefit through the system that has been established in the banking sector.

According to the head of Business Development at the ARB Apex bank Plc, the supervise all rural and community banks scattered across the country with regional offices to help in their supervisory work.

“…. when it comes to banking services with the rural banks, you can access whatever services you want to access from a high street bank just because of infrastructure and that, customers access to mobile services on their phones and with the services of the Gh link cards, customers can withdraw cash at any bank of their choice that is linked to the Gh link card” Mr Gordon said.

Dr Abu Sakara, the majority shareholder of the defunct Buuwuloso Rural bank disclosed that, the stakeholder engagement held to brainstorm towards the revival of the bank is what, they should have done in the past before establishing the bank.

He noted that, the challenges faced with the bank were a cabination of problems, one of which has to do with the area at the time coupled with high transaction cost relative to their customer base and the concentration of the people.

He added that, he is happy that other people can also feel ownership of the bank after the engagement and that, he is keen to see the bank coming back into operations by whatever means the stakeholders wants it and with a new board and a new management.

“….. I can assure you that, I will not remove one penny of my investment in that bank in other to give it the opportunity to rise and that the bank actually has a lot of assets” , Dr Sakara disclosed.

The member of parliament for Bole / Bamboi, Hon. Sulemana Yusif who is the chairman for savannah region caucus in parliament was part of the engagement processes representing members of parliament in the Savannah region.

Source:pafm.com.gh /Kumatey Gorden

0243531604